Sitowise is active in the Finnish and Swedish technical consulting market, which includes building and infrastructure consulting services, as well as in the IT service and solution market for built environment.

In 2020, the Finnish technical consulting market is estimated to amount to approximately EUR 1.5–1.7 billion, of which building consulting amounted to approximately EUR 1.0–1.1 billion and infrastructure consulting to approximately EUR 0.5–0.6 billion. During the same period, the Swedish technical consulting market is estimated to amount to approximately EUR 3.1 billion.

Sitowise is the third largest player in the technical consulting market [1] in Finland with an 8 percent market share [2]. Sitowise’s Swedish subsidiaries are small niche players on the Swedish market. The large amount of small and niche local companies enables continued consolidation in both the Finnish and Swedish markets.

Faster growth compared to the construction market, less exposed external effects

The technical consulting market value has increased over the past decade and is estimated to continue to grow. The growth is driven by increasing construction complexity, increasing technology content, tightening regulation and emphasis on sustainability, and greater focus on life cycle costs.

Even though the consulting market is expected to decline temporarily in 2021, the total Finnish market is expected to grow with a CAGR of 2.9 percent between 2020 and 2025, reaching EUR 2.0 billion in 2025.

The technical consulting market has historically been resilient compared to the overall economic development and the construction market. Consulting projects are carried out even in weaker periods in construction, creating backlogs for future design plans to be realized during stronger construction cycle periods. National public stimuli measures during downturns are usually targeted towards large infrastructure projects, which drives the demand for infrastructure consulting. Additionally, exposure to the stable infrastructure construction market as well as the large and defensive residential sector with significant renovation demand are drivers of resilience.

The Swedish technical consulting market develops similarly to the Finnish market.

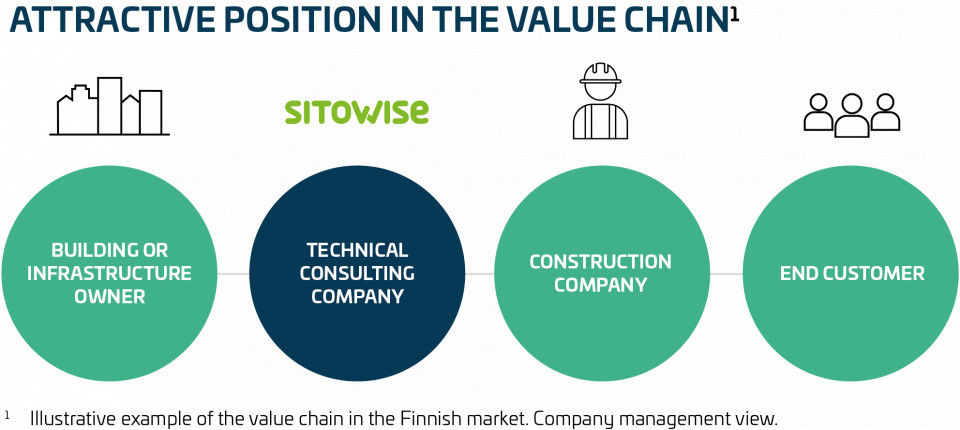

Attractive position in the value chain

Sitowise’s management considers that Sitowise and its competitors have an attractive position in the value chain as they do not act as contractors with responsibility for construction project execution or invest in the construction projects. Hence, the position in the value chain leads to a limited overall project risk.

Megatrends as growth drivers

Urbanization

Migration to the largest cities and growth centers in Finland and Sweden has been going on for decades. The population amount in the six largest Finnish cities is expected to increase by more than 15 percent during the time period between 2019 and 2040 [3], and similarly in Sweden by more than 21 percent [4]. The construction complexity arising from the increasing urbanization requires thorough plans and designs done by technical consultants. Hence, the demand for technical consulting services is expected to increase in line with the growing population in the major Finnish and Swedish urban areas. [5]

Renovation backlog

The ageing Finnish and Swedish building and infrastructure stock is expected to create an increasing need for maintenance and renovation services. The Finnish infrastructure renovation backlog is approximately EUR 6 billion. [6] According to the view of Sitowise’s management, the large renovation backlog, especially within residential buildings, brings resilience towards downturns, as many of the renovation and maintenance projects are crucial and cannot be postponed. Additionally, Sitowise management considers that the large building renovation backlog creates opportunities to optimize energy, water and space usage of the buildings. Thus, these opportunities create an increasing demand for technical consulting services.

Sustainability

According to the view of Sitowise’s management, building and infrastructure owners are currently increasingly focusing on investing in energy-efficient and low-emission solutions. Additionally, the tightening EU regulation increases sustainability efforts and the EU Taxonomy framework aims to reorient capital flows towards sustainable investments.

Sitowise management considers that the sustainability initiatives, directives and expressed targets are expected to lead to increased investment within important technologies aimed at increasing energy efficiency and which, in turn, will contribute to increased demand for skilled providers of technical solutions and designs.

Digitalization

Current buildings are characterized by intensive use of technical systems such as IT solutions, alarm and security systems, and systems for more efficient energy use such as sensors and monitors. Also, the technological content, such as emission reducing tools and digital tools for optimized infrastructure asset management, within infrastructure is also becoming more common. The increasing technology content in buildings and infrastructure is driven by increasing sustainability, safety and comfortable living environment requirements. [7] The complexity arising from increasing digitalization will also contribute positively to the demand for technical consulting services and, thus, drive the need for specialized planning and design skills found within technical consulting companies. [8]

- Technical consulting includes building and infrastructure consulting and excludes industrial engineering and digital solutions.

- Based on Sitowise’s 2019 IFRS net sales for Finland.

- Statistics Finland: Key figures on population by region, 1990-2019. Statistics Finland: Population projection 2019: Population according to age and sex by area, 2019-2040.

- Statistics Sweden: Population by region, marital status, age and sex, year 1968-2019. Statistics Sweden: Population projection 2019: Population size, number of birth, deaths and migration by region, sex and age, year 2020-2070.

- - 8 International management consultant analysis conducted in fall 2020 and commissioned by Sitowise.